India’s journey toward clean energy is in full pace, with sun power leading above all. Whether you’re a homeowner looking to lower electricity bills or a business aiming for greener operations altogether, solar panels are a game changer. But one question often pops up: how does GST on solar panel equipment affect the cost of going solar?

In this guide, we’ll unpack the current GST on solar panels as of September 8, 2025, explain its impact on buyers and panel companies, and highlight how trusted names like Ample Solar, Sun Solar, and Tata Power Solar Systems are making renewable energy sources more accessible for everyone.

GST on Solar Panels: The Current Picture

As of September 2025, GST on panels is set at just 5%. This rate applies not to the panels only but also to the key components like inverters, batteries, and mounting structures, everything you need for a complete solar system.

5% GST adds to the upfront amount. But when you consider savings in longer run, government subsidies, and flexible financing options, sun power remains a smart and affordable choice for homes and businesses.

Why GST on Solar Panels Matters?

For Everyday Consumers:

For homeowners and businesses, the GST on solar systems directly impacts what you pay at installation. The good news, Companies like Ample Solar are stepping up with budget friendly financing plans and expert guidance on subsidies to soften the upfront cost. While the initial price might feel higher, the long term savings on electricity bills and the environmental benefits make solar pannels the best choice.

For Solar Panel Companies:

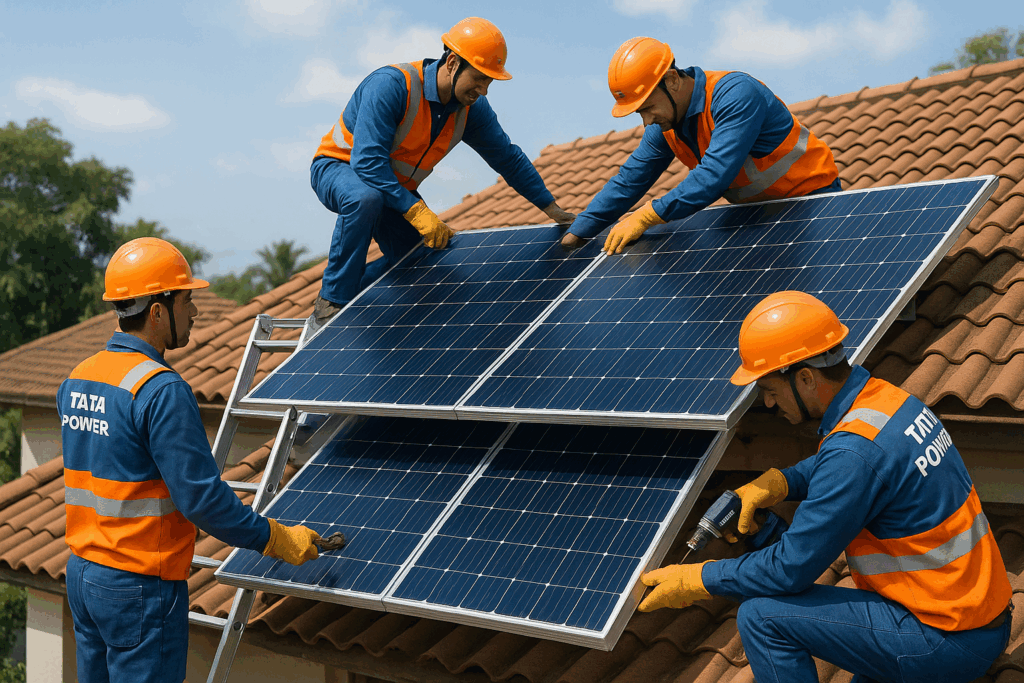

For solar panel companies, navigating GST is part of staying in the game. Industry leaders like, Ample Solar, and Tata Power are rising to the challenge by offering all in one solutions, covering everything from installation to maintenance and net metering. These packages help ease the GST burden for customers while building confidence in the solar industry.

GST and the Bigger Renewable Energy Picture

India is all in for all types of renewable energy sources, with ambitious goals to expand clean energy. While the GST on solar systems increases upfront costs, it also brings clarity and consistency to the market. A straightforward tax structure helps both investors and consumers feel confident in choosing sun power as a reliable, long term solution.

Conclusion

While 5% GST adds to the initial investment, the perks of going solar are lower bills, government incentives, cleaner energy, and lasting savings so why not make it well worth it.

Whether you’re partnering up with a trusted provider like Ample Solar, or an industry giant like Tata Power Solar, one thing is certain: India’s future is bright with sun power.

Ready to go solar? contact us now!